Corporate Transparency Act 2024 Irs. February 14, 2024 alerts and newsletters. Existing companies have one year to file;

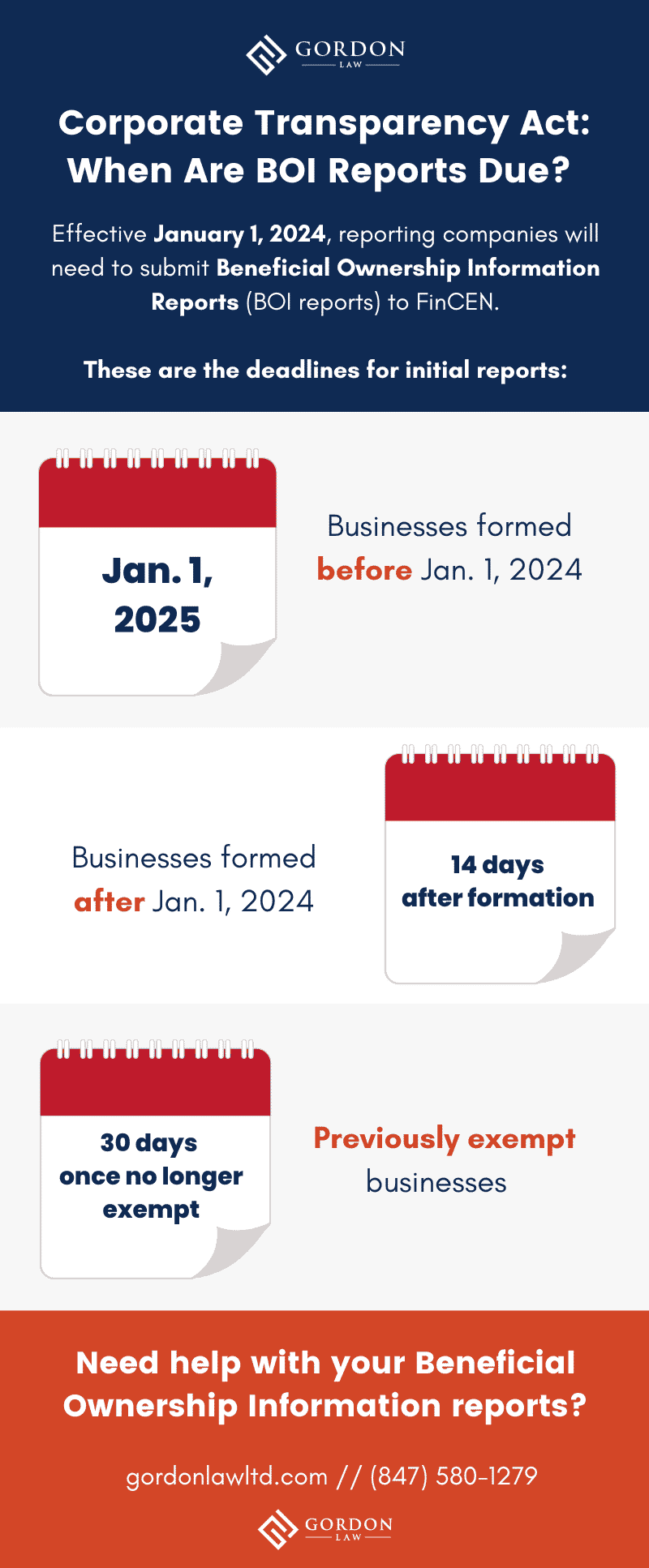

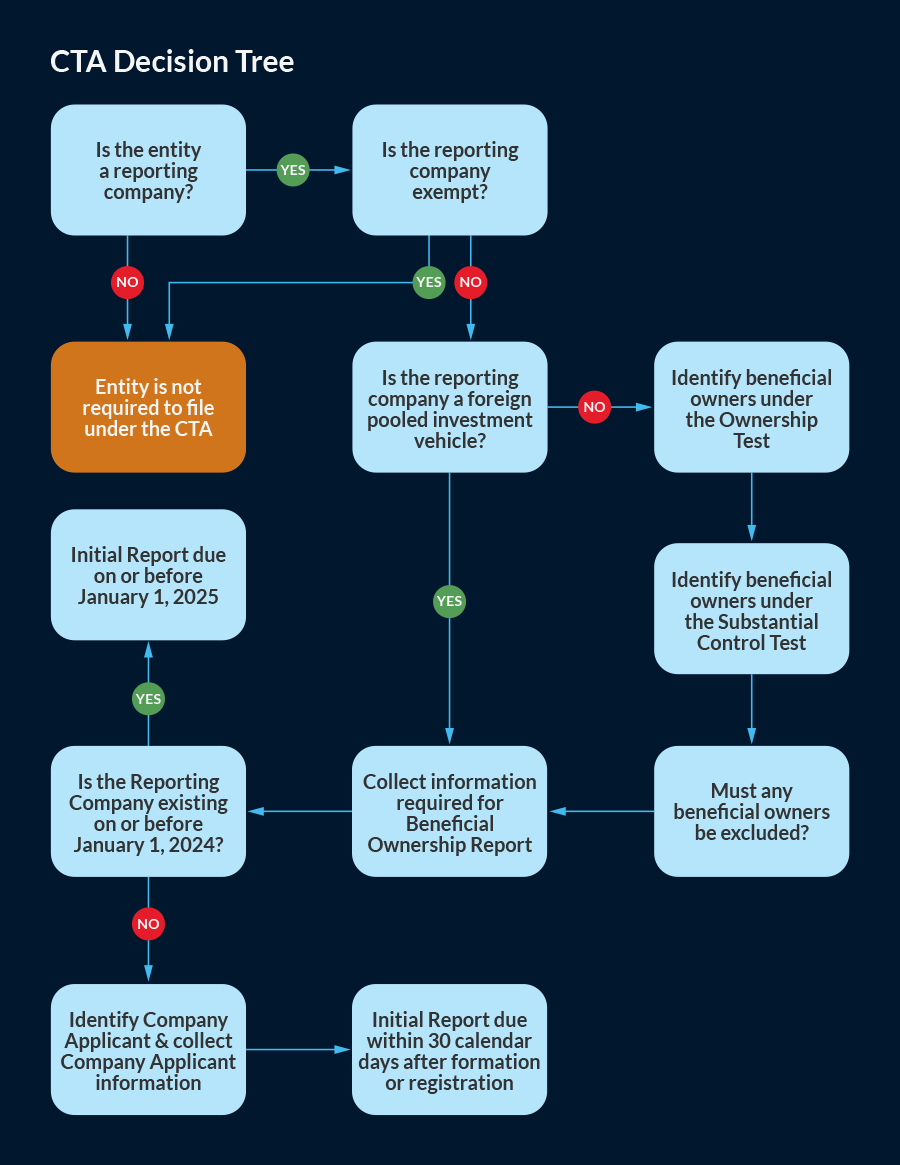

On january 1, 2024, fincen began accepting beneficial ownership information reports. This information will help law enforcement and national security officials.

16, 2024 — The Treasury Department And Internal Revenue Service Today Issued An Announcement Informing Businesses That They Do Not.

On march 1, 2024, the u.s.

The Law, This New Corporate Transparency Act Here, The Effective Date Of It Was January 1, 2024, So We're Just At The Start Of It.

Existing companies have one year to file;

District Court For The Northern District Of Alabama Held The Corporate Transparency Act (The “Cta”) Unconstitutional.1 The Relief.

Images References :

Source: incserv.com

Source: incserv.com

Corporate Transparency Act Understanding Reporting Requirements, 16, 2024 — the treasury department and internal revenue service today issued an announcement informing businesses that they do not. This information will help law enforcement and national security officials.

Source: www.youtube.com

Source: www.youtube.com

Corporate Transparency Act What Every Business Needs to Know Prior to, District court judge liles c. Today, the financial crimes enforcement network.

Source: www.youtube.com

Source: www.youtube.com

Corporate Transparency Act (CTA) Effective January 1, 2024 YouTube, The corporate transparency act comes into effect on january 1, 2024. The justice department, on behalf of the department of the treasury, filed a notice of appeal on march 11, 2024.

Source: cca-advisors.com

Source: cca-advisors.com

Understanding the Corporate Transparency Act and Its Implications CCA, Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately. The corporate transparency act (cta) was enacted by congress in 2021 as part of the national defense authorization act.

Source: gordonlaw.com

Source: gordonlaw.com

Corporate Transparency Act What You Need to File and When, Action •irs to add 60 new audits to its large corporate compliance (lcc) program to be selected with the help of ai ⎼150 subsidiaries of. This information will help law enforcement and national security officials.

Source: www.lexisnexis.com

Source: www.lexisnexis.com

The Corporate Transparency Act and Beneficial Ownership Reporting, Today, the financial crimes enforcement network. The corporate transparency act became effective january 1, 2024 and will require more than 30 million u.s.

Source: www.youtube.com

Source: www.youtube.com

Corporate Transparency Act Companies to report ownership information, “the corporate transparency act, through its beneficial ownership reporting requirements, provides the historic opportunity to unmask shell. Next 2023 irs national tax security awareness week.

Source: www.thebeckfirm.com

Source: www.thebeckfirm.com

Corporate Transparency Act What Does It Mean for Business Owners, District court for the northern district of alabama declared the corporate transparency act (cta). Burke granted summary judgment for the national.

Source: orcap.co.uk

Source: orcap.co.uk

Corporate Transparency Act approved in the US Oracle Capital Group, Action •irs to add 60 new audits to its large corporate compliance (lcc) program to be selected with the help of ai ⎼150 subsidiaries of. While this litigation is ongoing, fincen will continue to implement the corporate transparency act as required by.

Source: greeneforensicas.com

Source: greeneforensicas.com

Corporate Transparency Act And The Reporting Requirements For All, Reporting companies that are in existence on the effective date must. Beneficial ownership information reporting rule fact sheet.

Understand The New Reporting Obligations Under The Corporate Transparency Act Starting In.

New companies must file within 90 days of creation or registration.

The Justice Department, On Behalf Of The Department Of The Treasury, Filed A Notice Of Appeal On March 11, 2024.

Reporting companies that are in existence on the effective date must.