401k Catch Up Contribution 2024 Date. If you are 50 or older, you can defer paying income tax on $30,000 in your 401. — for 2024, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

There are annual limits to how much you can contribute to your 401 (k). — here are the details:

401k Catch Up Contribution 2024 Date Images References :

Source: briannewreggi.pages.dev

Source: briannewreggi.pages.dev

401k Catch Up Contribution Changes 2024 Cyndia Danyelle, If you're age 50 or.

Source: heathykessia.pages.dev

Source: heathykessia.pages.dev

401k Contribution Limits 2024 Catch Up Total Taxable Netta Wilone, For individuals under 50, the standard 401 (k) contribution limit in 2024 23,000.

Source: dienadorolisa.pages.dev

Source: dienadorolisa.pages.dev

401k Contribution Limits 2024 Catch Up Total Robby Christie, Plan participants can contribute up to $23,000 for 2024, which is up.

Source: danabannette.pages.dev

Source: danabannette.pages.dev

401k Max Contribution 2024 CatchUp Dacey Dorette, — the 401(k) contribution limit is $23,000.

Source: davitabrenate.pages.dev

Source: davitabrenate.pages.dev

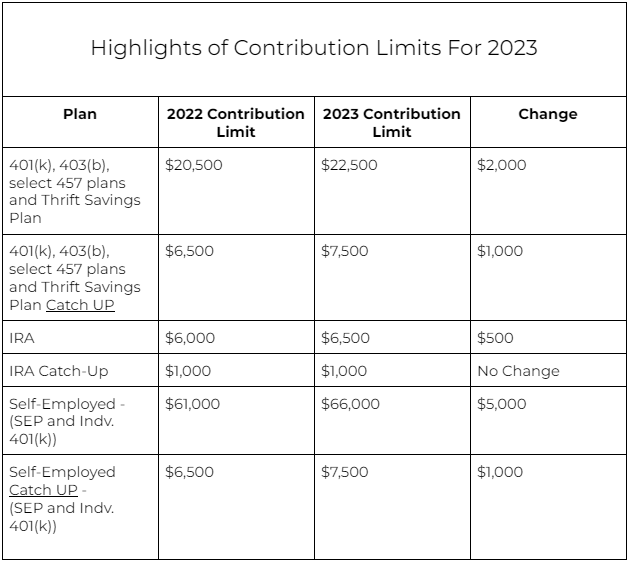

401k Limits 2024 Catch Up Lissy Phyllys, — the 401(k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

Source: eadithlyndsie.pages.dev

Source: eadithlyndsie.pages.dev

Max 401k Catch Up Contribution 2024 Leia Austina, Consider the limit for ira contributions for those 50 and older in 2023:.

Source: jolyyandriette.pages.dev

Source: jolyyandriette.pages.dev

401k Contribution Limits 2024 Catch Up Total Zorah Lorianna, Those 50 and older can contribute an additional $7,500.

Source: jolybgabriela.pages.dev

Source: jolybgabriela.pages.dev

Catch Up Contributions 2024 401k Heda Rachel, — the 401(k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

Source: lidiaywendie.pages.dev

Source: lidiaywendie.pages.dev

401k Max Contribution 2024 CatchUp Cara Vittoria, Plan participants can contribute up to $23,000 for 2024, which is up.

Source: shirlqaloysia.pages.dev

Source: shirlqaloysia.pages.dev

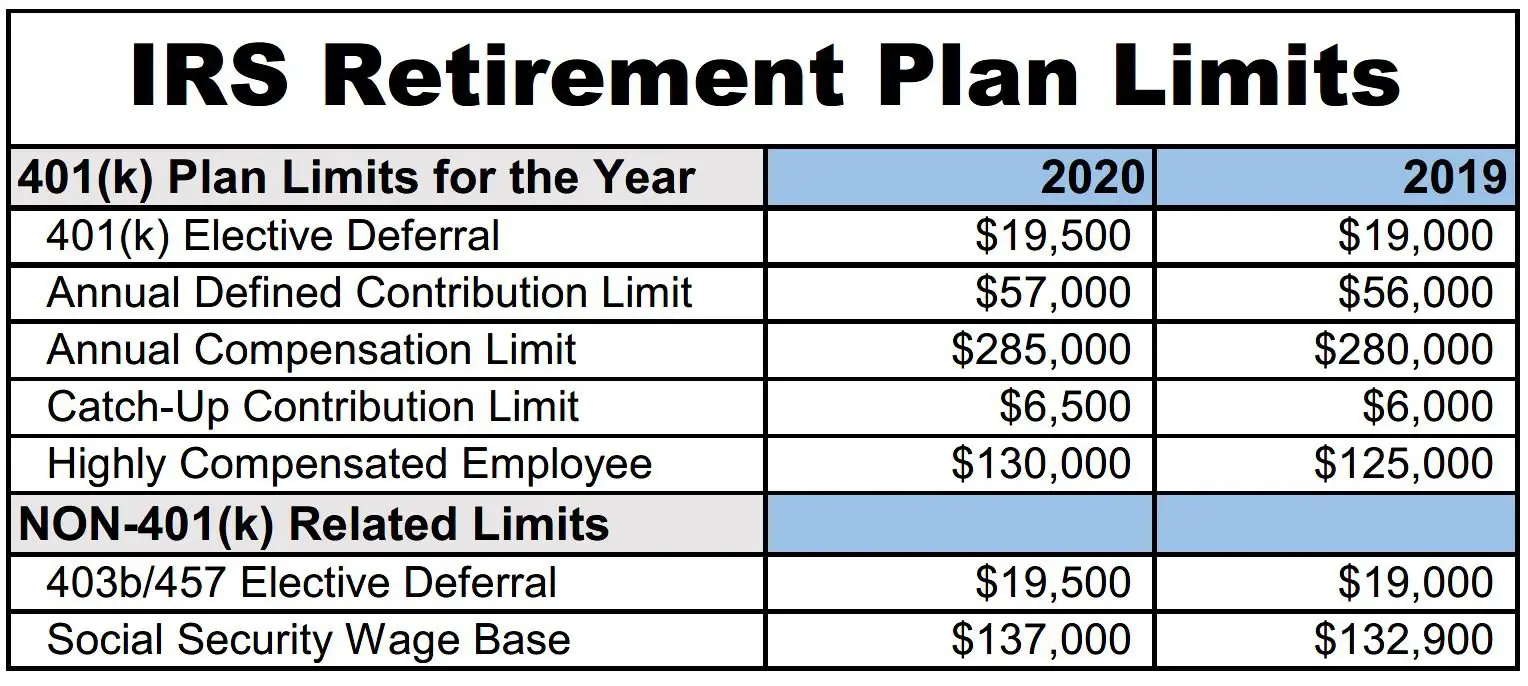

Irs 401k Catch Up Contribution Limits 2024 Joell Madalyn, — that compares with the $500 boost seen in 2024 over 2023.